Elements of Successful Fundraising Campaign

Strategies for securing capital and driving growth

Successful investor campaign usually boils down to three main things: figuring out which investors to focus on, putting together a story that grabs attention, and keeping all the behind-the-scenes campaign stuff organized and running smoothly. Each of these steps is what really plays a vital role in ensuring that startups can effectively engage with potential investors and secure the necessary funding.

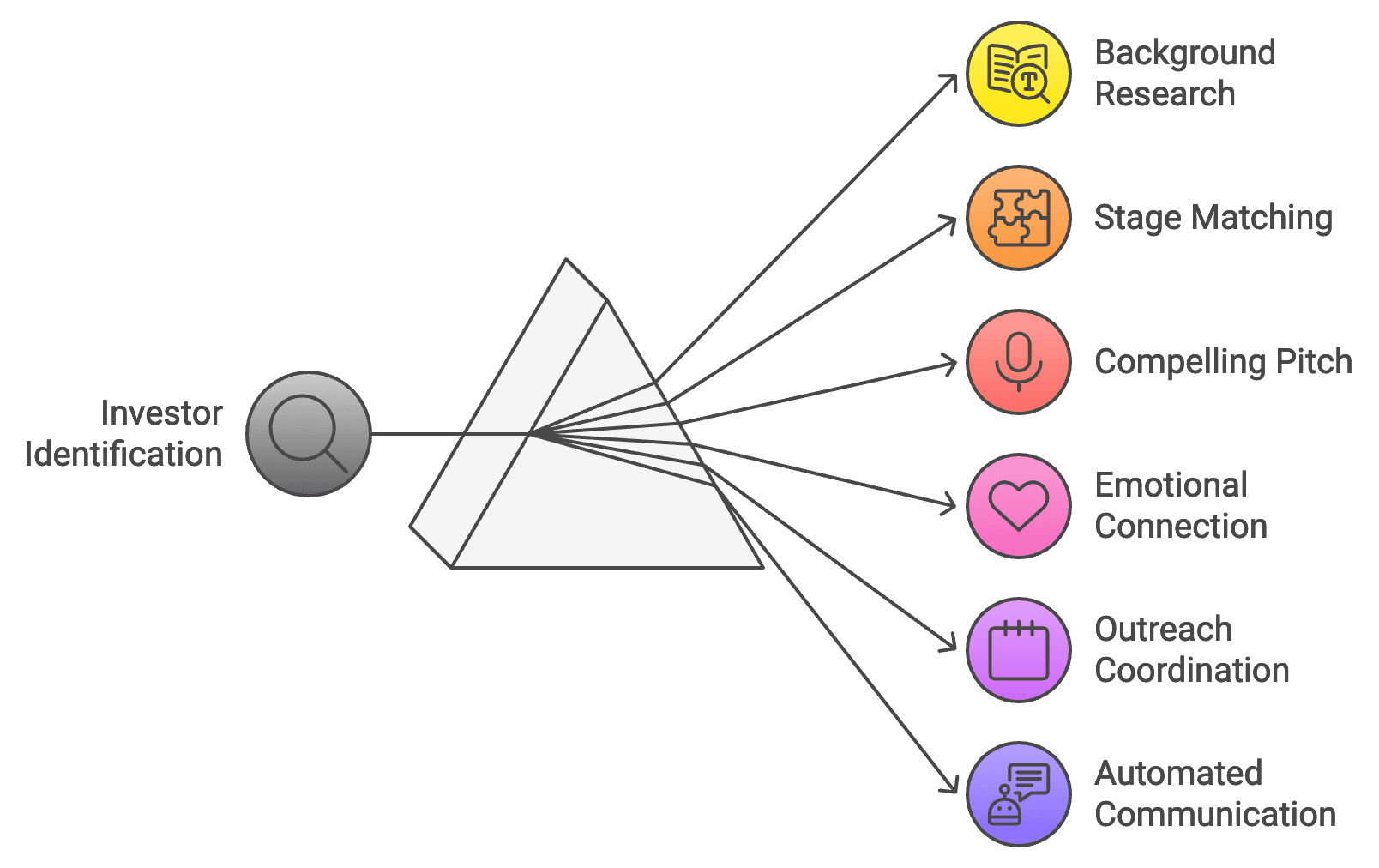

Zeroing in on the Right Investors

Identifying the right investors is paramount for any startup seeking funding. This process involves:

- Scoping Out Investor Backgrounds: A little digging into who's invested in similar domain before can give startups a head start. Looking at past interests, specific investment criteria, and even the types of industries they are into right now. Understanding their investment criteria and current interests can help tailor approaches that resonate.

- Matching the Investor to the Startup Stage: Not all investors are looking to get in at the same stage, so finding those that fit where a business is currently at can make a difference. For instance, early-stage companies may benefit more from angel investors who provide not only capital but also mentorship and connections.

- Using Investor Databases: Platforms can offer valuable insights into potential investors, helping startups to identify individuals or firms that align with their vision and goals.

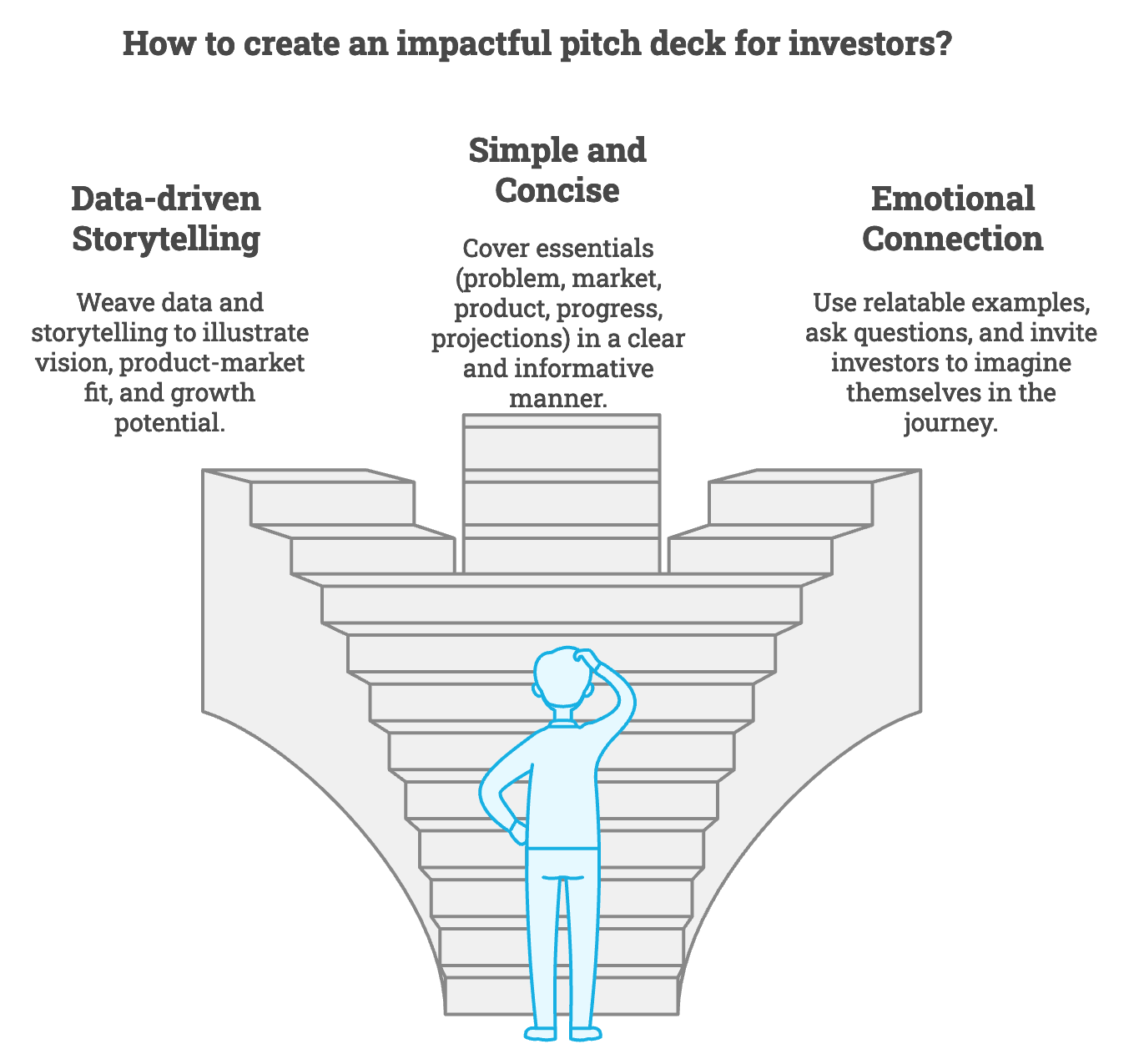

Building a Story that Resonates

When it's time to actually pitch, the story has to be both clear and compelling. Here's what that involves:

Using Data with a Storytelling Twist: A compelling pitch should weave together data and storytelling techniques to illustrate the startup's vision, product-market fit, and growth potential. This approach helps to create an emotional connection with investors, making the pitch memorable.

Keeping the Presentation Simple but Impactful: A pitch deck that covers the essentials (like the problem, market potential, product edge, progress, and money projections) helps investors see the big picture. Each section should be concise yet informative, ensuring clarity and transparency about the business model.

Adding Emotional Pull: Little things like asking questions, building relatable examples, or inviting investors to imagine themselves as part of the journey can really boost connection. This emotional touch can also put investor concerns at ease and build trust early on.

Coordinating the Campaign and Getting the Tools in Place

The whole fundraising effort needs a strong backbone behind it—good coordination keeps things moving forward:

Setting Up the Outreach System: A CRM tool can do wonders here by organizing every investor interaction. This organization is vital for maintaining follow-ups and ensuring no opportunities are missed.

Automating Outreach Where Possible: Automating LinkedIn messages and personalizing emails with AI can save time and make it easier to reach a bigger crowd without spreading the team too thin.

Planning a Follow-Up Routine: Regular check-ins and updates can keep investors interested and tuned into any new milestones. A well-paced follow-up strategy keeps the conversation going throughout the fundraising.

Bringing these pieces together—finding the right investors, putting heart into the story, and staying organized—startups can significantly enhance their chances of running a successful fundraising campaign.

Book a call to discuss your project investment needs further: Meeting Link